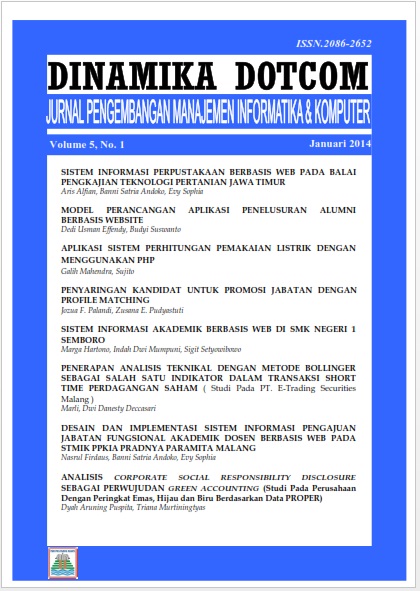

PENERAPAN ANALISIS TEKNIKAL DENGAN METODE BOLLINGER SEBAGAI SALAH SATU INDIKATOR DALAM TRANSAKSI SHORT TIME PERDAGANGAN SAHAM ( Studi Pada PT. E-Trading Securities Malang )

Abstract

Investments are placement of funds at this time of the financial assets and real in the hope to earn profits in the future, in return for the time and risks related to these investments. One means is to invest through the capital market. The capital market is a meeting place between parties who have surplus funds to those who need the funds by way of trade in securities. And one of the instruments in the capital markets are trading the stock.

Stock is proof of ownership of the assets of the company that issued the stock. As one of the means of investment, stock investment also contains a risk. And to deal with the risk, then an investor needs to do stock analysis to help make decisions to buy or sell shares

One analysis that can be used is technical analysis. Technical analysis is a method to predict stock price movements and predict market trends in the future by studying the stock price charts and trading volume. One method that can be used in technical analysis is a method of Bollinger.

Bollinger is one of the methods of volatility indicators commonly used to see market forces as seen from price fluctuations within a certain time period. A market is said to have a high volatility if the movement takes place up and down sharply or very volatile, where there is a large difference between the highest and lowest prices. Bollinger Bands are early indicators that can not be used as an indicator of action, should be used in conjunction with other indicators such as RSI.

In the use of Bollinger method, the data used is the stock price within a certain time period. In this study , which used be the object of study is three mining companies whose shares are listed as LQ45 in Indonesia Stock Exchange during the period August 1, 2012 until July 31, 2013 . The company is PT. Bumi Resources, Tbk, PT. Aneka Tambang, Tbk, and PT. Tambang Batubara Bukit Asam, Tbk .

Keywords : Technical Analysis , Bollinger

References

Bungin, Burhan (2007), Penelitian Kualitatif : Komunikasi, Ekonomi, Kebijakan Publik dan Ilmu Sosial Lainnya, Kencana, Jakarta.

Bollinger Bands, online diakses 21 Februari 2009. (http://www.investopedia.com)

Bappenas, diakses 28 November 2013. www.bappenas.go.id

Darmawan, Daud. M (2006), Mengenal Bisnis Valuta Asing Untuk Pemula, Penerbit Pinus, Yogjakarta.

Halim, Abdul (2005), Analisis Investasi, Edisi 2, Salemba Empat, Jakarta.

Husnan, Suad (1998), Dasar-Dasar Teori Portofolio dan Analisis Sekuritas, Edisi ketiga, Unit Penerbit dan Percetakan AMP YKPN, Yogjakarta.

Jogiyanto (2000), Teori Portofolio dan Analisis Investasi, BPFE, Yogjakarta.

Nazir, Moh (1988), Metode Penelitian, Gahlia Indonesia, Jakarta.

Sekaran, Uma (2006), Research Methods for business, Edisi 4, Salemba Empat, Jakarta.

Sharpe, William F., Gordon J.Alexander, Jeffery V. Baily (2005), Investment, Indeks, Jakarta.

Sugiono (2008), Metode Penelitian Kuantitatif, Kualitatif dan R&D, Alfabeta, Bandung.

Sulistiawan, Dedhy, Liliana (2007), Analisis Teknikal Modern Pada Perdagangan Sekuritas, Penerbit Andi, Yogjakarta.

Tandelilin, Eduardud (2001), Analisis Investasi dan Manajemen Portofolio, Edisi pertama, BPFE, Yogjakarta.

Vibby, Santo (2008), Jual Saham Anda Lebih Mahal, Vibby Publishing, Jakarta.